Endless Possibilities for LINCONE Members

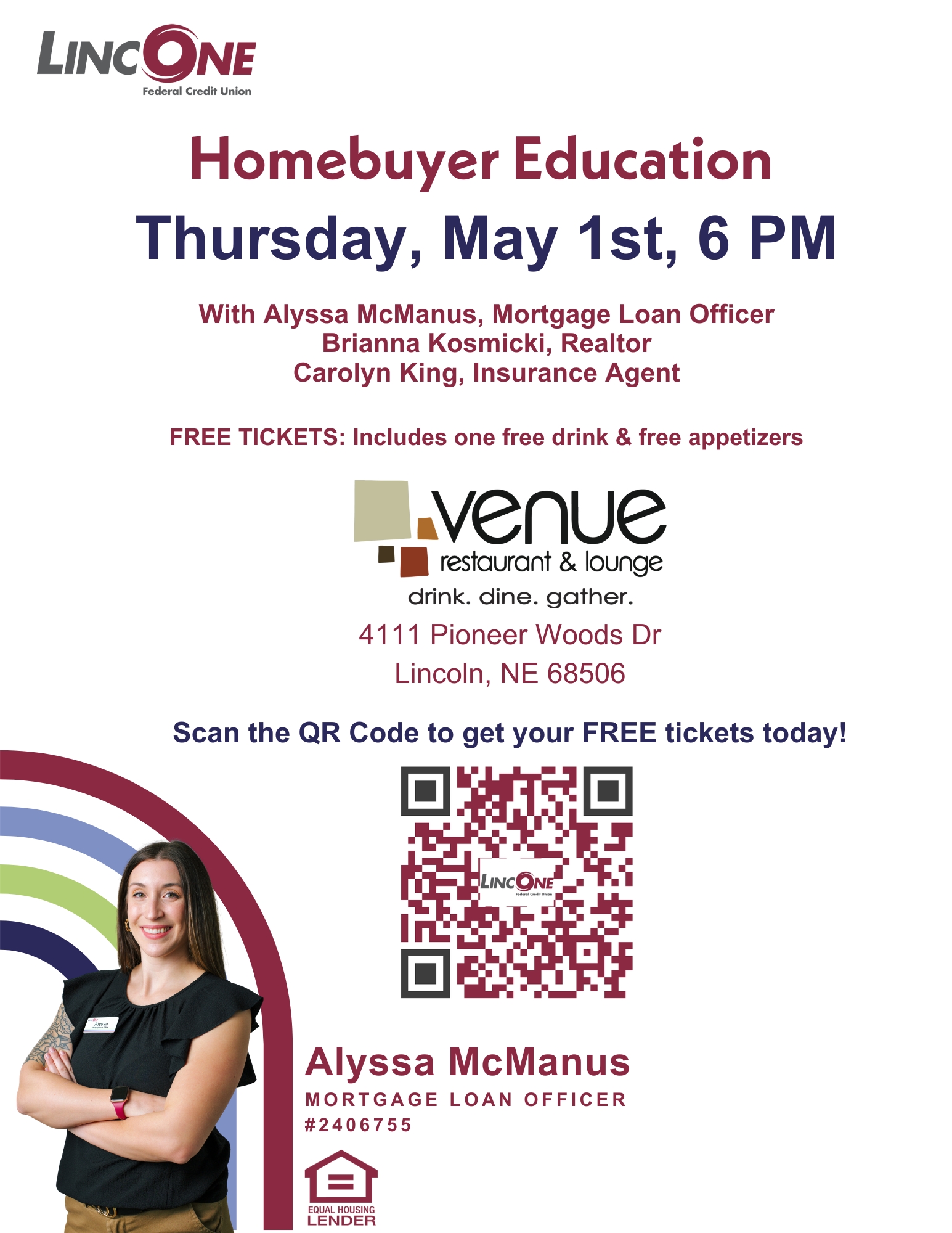

Alyssa McManus - Mortgage Loan Officer

NMLS #2406755

402-417-7691 ext. 691

Cell Phone - 402-540-4489

One of the most important financial decisions you will make is buying a home. When you’re ready to buy your first home, a new home, or to refinance your existing home, contact LINCONE first.

Your mortgage rates are determined by many economic factors and tend to change frequently. If you are ready to apply, contact us here by email, call 402.441.3555, stop by one of our three locations, or complete an Online Mortgage Application today. Please be aware that we are only able to originate loans on properties located in the state of Nebraska.

Due to a continually changing market and ever changing rates, please contact us for current rates on the following product offerings, conventional, VA and FHA.

Types of Home Loans Offered by LINCONE

At LINCONE, we offer three categories of home loans: conventional, VA, and FHA. Each of these loan types has different requirements and benefits, so it’s important to speak with a loan officer to determine which is best for your individual situation. Our loan officer will guide you through what each of these different types of home loans are and how they can benefit you whether you are a first time home buyer, investor, or just making a move.

How to Qualify for a Mortgage Loan With LINCONE

For pre-qualification, we don’t legally require any documentation. We use the information entered in the application and the credit report received to determine credit score, payment

history, cash to close, and debt-to-income ratio.

How Long Does it Take to Get a Mortgage Approved With LINCONE?

The time it takes to get approved for a mortgage with LINCONE varies depending on the individual’s scenario. Generally, it takes about 30 days from the time of receiving an accepted contract to close. However, it can take as quickly as 14 days or up to 60 days in extreme cases where repairs are needed prior to closing.

Do You Need a Down Payment to Get Pre-Approved with LINCONE?

The only program that is offered with LINCONE that does not require a down payment is the VA mortgage loan. Down payment ranges anywhere from 3% to 20% depending on factors such as income, property type, and whether it will be a primary residence or investment property. The down payment isn’t required at the time of pre-qualification, but rather when the loan itself

closes.

Loans for First-Time Homebuyers

There's not one specific loan that fits every first-time home buyer. It depends on the individual's situation and goals for the home they're buying. If it's a starter home that the borrower knows they will likely be moving out of within the next four or five years, an FHA loan is recommended because of its lower interest rate. If it's a longer-term home and the borrower can put down a larger down payment, a conventional loan is suggested because private mortgage insurance will fall off at some point during the loan. These details aren't asked on the application but are discovered after the qualification determination and digging deeper into the borrower's experience, credit history, and goals for the property.

Understanding the different types of home loans and the qualifications needed to obtain them is crucial for anyone looking to buy a home. By working with LINCONE, you can get the personalized guidance and support needed to navigate the home-buying process with confidence.

There's not one specific loan that fits every first-time home buyer. It depends on the individual's situation and goals for the home they're buying. If it's a starter home that the borrower knows they will likely be moving out of within the next four or five years, an FHA loan is recommended because of its lower interest rate. If it's a longer-term home and the borrower can put down a larger down payment, a conventional loan is suggested because private mortgage insurance will fall off at some point during the loan. These details aren't asked on the application but are discovered after the qualification determination and digging deeper into the borrower's experience, credit history, and goals for the property.

Understanding the different types of home loans and the qualifications needed to obtain them is crucial for anyone looking to buy a home. By working with LINCONE, you can get the personalized guidance and support needed to navigate the home-buying process with confidence.

Consumer Financial Protection Bureau: Your Home Loan Toolkit

CFPB Multilingual Resource Home Page: https://www.consumerfinance.gov/language/

Arabic Resource: https://www.consumerfinance.gov/language/ar/

Spanish Resource: https://www.consumerfinance.gov/es

Vietnamese Resource: https://www.consumerfinance.gov/language/vi/

HUD Approved Housing Counseling Agencies for Nebraska

Fannie Mae Homebuying Myths vs. Facts

Habitat For Humanity Benefits of Homeownership