Upgrade Updates

Our Mobile App is live!

Please note: If you have already registered for the new Online Banking, you will use the same Username and Password for the Mobile App.

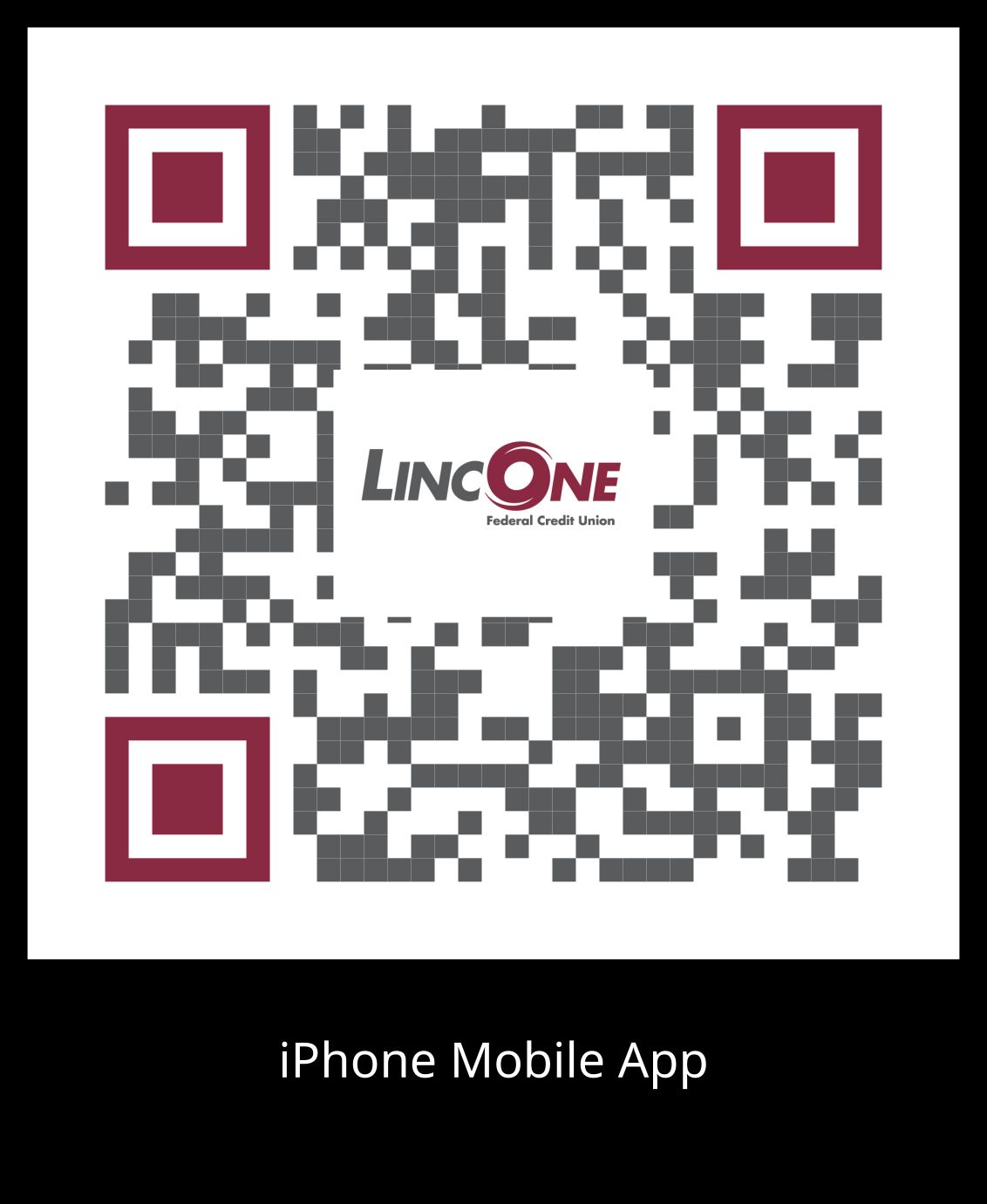

Download the LincOne Mobile App from the Apple App Store Today!

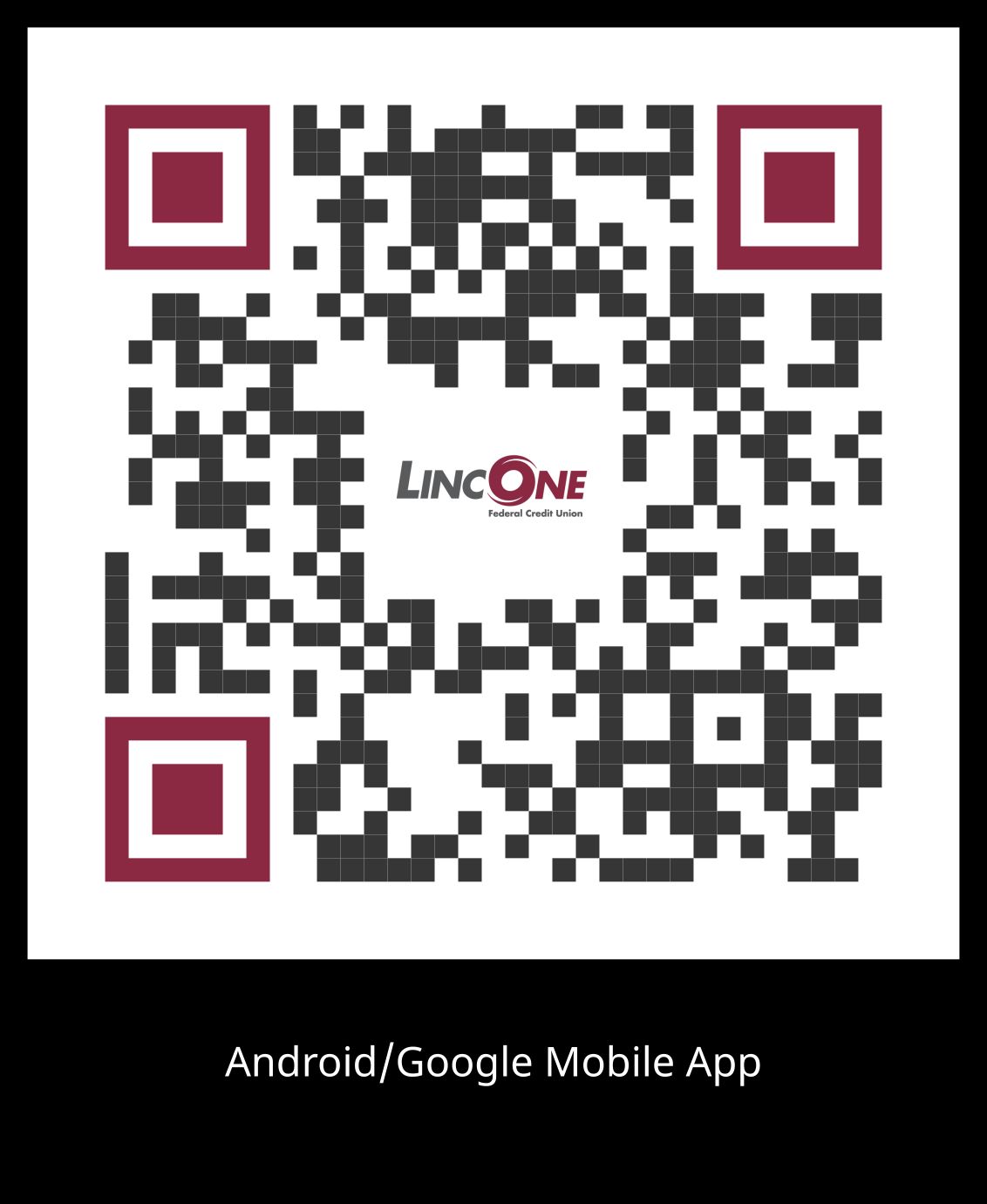

Android and Google Users: Before downloading our new mobile app, please delete the current version of our mobile app that is on your phone. After deleting our previous app please use the link above to download our new mobile app from the Google Play Store! Our current listing on Google Play Store will be available in the next few days, but you can access the new app right now through the link above.

Download the LincOne Mobile App from the Google Play Store Today!

Other Upgrade Items

- Your loan suffix may have changed in Online Banking. You can find it at the end of your account number in the payment portal. Please check your Online Banking to confirm your loan suffix before making a payment!

Upgrade How-To Videos

How to Login to LincOne's New Online Banking

Navigating Online Banking

Our updated Online Banking is live! Please see below for registration instructions.

Please note: Our credit card single sign on withinin Online Banking is currently not available. We will provide updates on this webpage as soon as possible.

LOGIN REGISTRATION INSTRUCTIONS

Registration Information Required:

- 1. Go to our website's homepage. Click Online Login.

- 2. Click "First Time User?"

- 3. Enter your Account Number as your temporary username.

- 4. Enter your Social Security Number as your temporary password.

- 5. Click Continue.

FIRST TIME USER:

Please click First Time User.

Username: Your LincOne Account Number as your temporary Username

Password: Your full Social Security Number as your temporary password

EXAMPLE: The account number is 11257, their social is 123456789

User ID: 11257

Password: 123456789

After successfully logging in you will be required to:

- 6. Choose a new Password (case sensitive, minimum of 8 characters, one number and & one special character required)

- 7. Select three new Security Questions (not case sensitive)

- 8. Review and accept the terms and conditions.

- 9. Choose your username (not case sensitive)

A one-time passcode will be sent via text or email; device recognition can be turned on. After successfully completing the registration, these will serve as your new Username, Password and Security Questions for online banking and the mobile app. Please watch our Logging in for the first time video for visual step by step instructions.

UPGRADE FREQUENTLY ASKED QUESTIONS

Service Availability

No, you will still receive your statements in the mail.

New Features

By upgrading our systems, we will have many opportunities to enhance the services available to members. Some of these include:

- Enhanced Online/Mobile Banking Experience!

- Early Pay Day: Post pending direct deposits on demand!

- Text Banking: Check a balance, transfer money, or receive an alert by text.

- Account to Account Transfers: Transfer funds between LincOne and your account(s) at other financial institutions.

- Stop Payments: Place a stop payment through online/mobile banking.

- Open SubAccounts: Open additional savings accounts through online/mobile banking.

Accounts

No, account numbers will not change. However, suffixes for shares and loans will change.

Yes, you can continue to use your current checks.

No, there should be no changes to automatic transfers or payroll allocations.

No, current debit card numbers and PINs will remain the same.

Yes, account statements will have a new look after February 2025.

- Previous Statements: Copies of previous account statements will be available by request.

- Electronic Statements: Archived Estatements (before January 2025) will not carry over to the new online and mobile banking systems.

- After February 2025, members who are currently enrolled for electronic statements will begin to receive e-statements in the new online and mobile banking platform(s).

Yes, debit and credit cards, deposits, and bill payments will continue to function as normal during the upgrade.

There will not be user access to online banking, mobile app, VISA credit card single sign-on, or bill pay access, payments will still process normally.

Online Banking Users

Yes, members can register their accounts for the new online/mobile banking platform beginning Monday, February 3rd. Members will need their account number to register for the new system.

- New Login: Members will register with a new username and password. When members register for the first time, they will enter:

- User Name: Account Number

- Temporary Password: Last 4 of Primary’s SSN + Year of Birth (ex. 43212001)

Yes, you will see different suffixes for your share and loan accounts.

If you have nicknamed any sub-accounts, these descriptions will still show in your online/mobile banking.

The order in which accounts are listed may be changed, depending on when the account(s) were opened.

You will need to set up alerts in the new online/mobile banking system. Previous text or email account alerts that were set up in the previous system(s) will not carry over to the new system.

Yes, if you are currently enrolled to receive notices electronically, you will not need to enroll again.

Yes, your recent account history will carry over to the new system. Account history after February 2025 will also be retained for a longer time frame than what was available in the previous system.

Yes, if you have authorized “cross-accounts” for transfers, you will be able to do so in the new system. You will need: Account Number, Suffix, and First Three Letters of the Primary Account Holder’s Last Name.

No, you will still need to login to each account with a unique username and password.

estatements from before January 2025 will not carry over to the new online and mobile banking systems.

eStatement users will receive a physical January 2025 statement in the mail.

-

- Members who are currently enrolled for electronic statements will begin to receive e-statements in the new online and mobile banking platform(s) beginning February 2025.

No, prior year tax forms will not be available in the new online banking system. Tax forms for 2024 will be mailed and made available by request.

Yes, the new mobile app will have an updated check deposit feature.

Yes, your Bill Pay account will carry over to the new system.

Telephone Banking (Teledata-24)

The phone number for the automated telephone banking service will change.

Please use 833.743.0164.

Instructions:

For English - Press One

For Spanish - Press Two

Enter Member Number and # Sign

Enter last four of social (Personal Identification number and # sign)

Loan Payments

Yes, after the upgrade your payments will continue unless you request a cancellation.

Yes, you will still be able to make a debit card or ACH payment through the Make a Loan Payment link on our website.

- Will I need to register again for the online payment portal? No, if you are currently registered for the online payment portal, you will not need to register again.

Debit Cards

Yes, your debit card will function as normal.

Credit Cards

Yes, the VISA credit card single-sign-on will be available after the upgrade.

Go to main navigation